Discretionary Trusts Everything You Need to Know BOX Advisory Services

Discretionary Trusts for Dummies Andreyev Lawyers

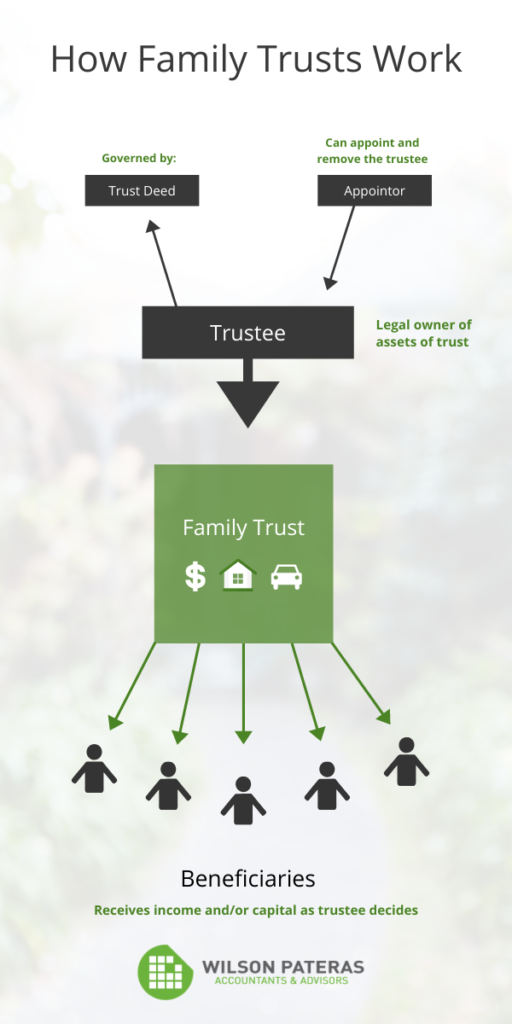

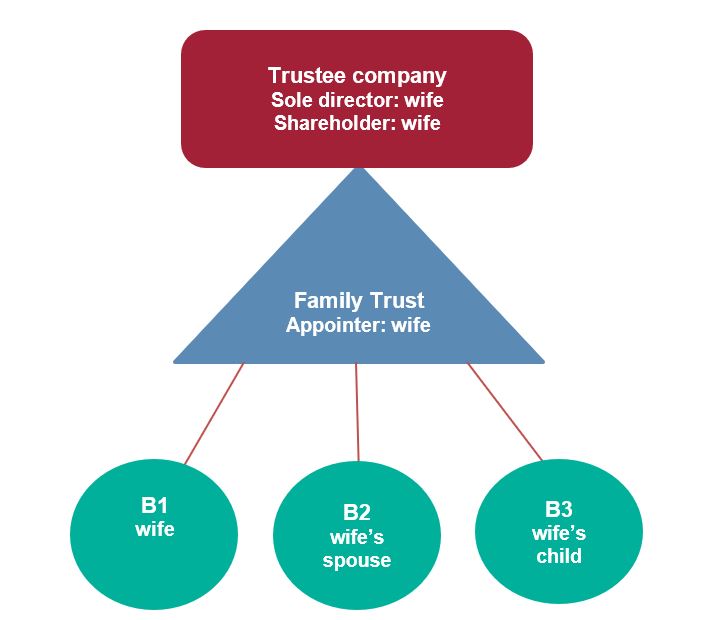

A family trust is a type of discretionary trust set up to benefit family members. In a discretionary trust, the trustee has discretion over how much each beneficiary receives, whereas in other trusts, distributions might be fixed. Can an accountant set up a family trust? Yes, an accountant can assist in setting up a family trust using a lawyer.

An update on the use of a corporate beneficiary Cooper Partners

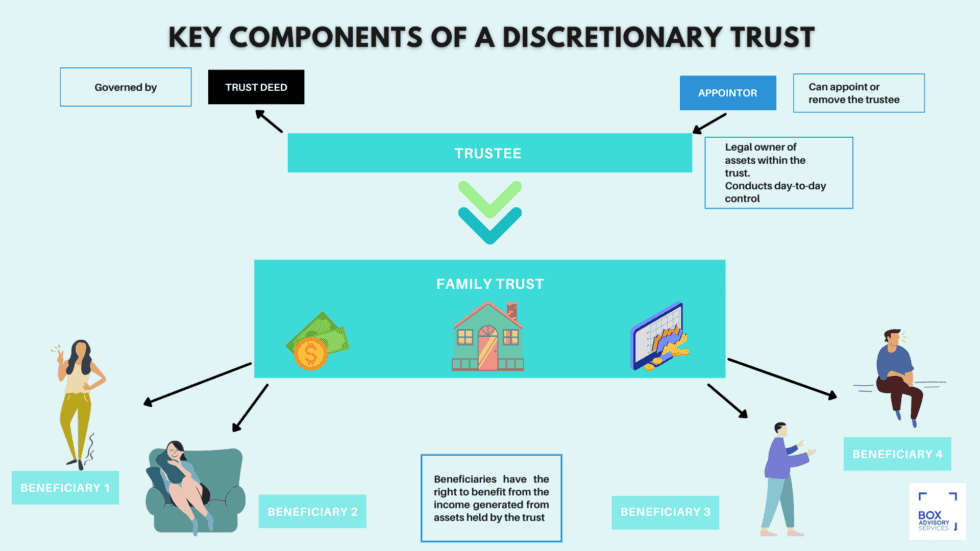

A discretionary trust means that trustees control who can benefit from the trust, and how much payment they get. A family trust can be a kind of discretionary trust, that usually benefits your family and is managed by a family member. Trusts can be useful for various reasons, but are not to be entered into lightly.

Revocable Trust vs. Irrevocable Trust What's the Difference?

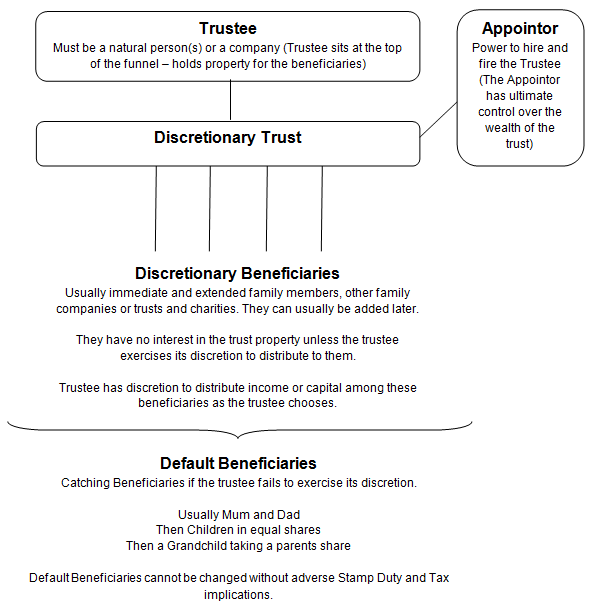

A Discretionary Trust is set up for the benefit of a beneficiary or beneficiaries, but for which the Trustee is given full discretion. The Trustee decides when and how much funds are distributed to the beneficiaries. In turn, the beneficiaries have no rights to the funds held in the Trusts. Further, the funds held in the Trust are excluded from.

Discretionary Family Trusts

A discretionary trust helps protect your beneficiaries in several ways including: Those with poor money-management skills. People with drug or alcohol abuse problems. Estate taxes. Adding age restrictions for distribution. Guarding against extravagant spending. Loved ones who need or may need governmental assistance.

Discretionary Trusts Everything You Need to Know BOX Advisory Services

A discretionary trust therefore is one where the trustee, commonly a private family controlled company, enjoys the freedom to make choices over the control and allocation of assets and income, for the benefit of the beneficiaries. In Australia these conduct family businesses, hold equity interests in private enterprises and conduct private.

Family Trust vs. Living Trust What’s the difference? Marketing and Websites for Attorneys

At law, discretionary beneficiaries do have a right to see the accounts of the trust, this includes profit and loss statement, balance sheets, tax returns and minutes of meetings. We note, that the trust deed may limit the types of documents that the trustee is bound to provide to the beneficiaries. You are entitled to call on unpaid distributions.

Family Trusts What You Need to Know

Advantages of a Discretionary Trust. A discretionary trust can be beneficial for asset protection and tax purposes. Some potential benefits of this structure include: Estate planning for the benefit of members of the "family group" in the event of an unexpected death. Trust property is exempt from creditors.

Are family trusts protected from divorce? Cooper Grace Ward

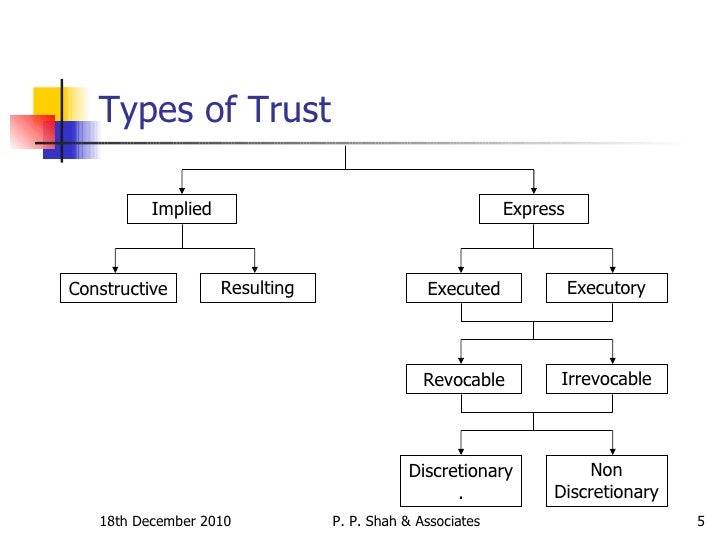

Discretionary trusts are a type of irrevocable trust, meaning the transfer of assets is permanent. When someone creates a discretionary trust they can name a trustee and one or more successor trustees to oversee it. This person is typically someone the grantor can trust to use their discretion wisely in managing trust assets on behalf of the.

All you need to know about family trust funds Family trust, Family trust fund, Trust fund

A discretionary trust is like a fixed trust for which the settlor does not set fixed beneficiaries or trust interest amounts. The trustee of a discretionary trust has the power to decide which beneficiaries will benefit from the trust. He or she also has the right to decide the extent of its benefits. Although most discretionary trusts allow.

Understanding Trusts Discretionary vs Family

A family trust is simply any trust vehicle you set up to benefit family members. The person who creates it is the grantor (also called the trustor or settlor). The grantor establishes the trust and places assets into the trust.. Discretionary trusts are an option when the grantor is concerned about their beneficiary's ability to manage the.

Trust Law Discretionary & Unit Trusts Lawyers Queensland FC Lawyers

Discretionary trusts are a type of irrevocable trust where the trustee has complete discretion on when and what amounts of assets to distribute to the beneficiaries.The beneficiaries have no right to distributions from the trust. The trustee typically has no limits on discretion besides those imposed by fiduciary duties.This structure prevents creditors from acquiring assets from the trust.

Family Trust (Discretionary Trusts) A Guide for Business Owners in Australia Impala Tax

A family trust is still a discretionary trust. However, a Family Trust Election (FTE) has been lodged meaning only immediate family members (parents, grandparents, spouses, children, brothers and sisters) can be beneficiaries of the trust. It means trusts with this election can stream things like franking credits on investment income to their.

Discretionary Family Trusts & Wills by TurksLegal issuu

Family Trust. Although many discretionary trusts (and even some unit trusts) are often referred to as "family trusts"; i.e., having been set up to benefit a particular family, references, in these notes to a "family trust" are references to a family trust as defined for tax purposes in the trust loss provisions of Schedule 2F of the.

Discretionary Trusts Everything You Need to Know BOX Advisory Services

Family courts, then, have taken three distinct approaches to valuing an interest in a discretionary trust: The "fair value" approach: the court examines the fair market value of a beneficiary spouse's interest in the family trust by asking how much such an interest would bring on the open market; The "pro rata" approach: the court.

Family Trust Explained Everything You Need To Know About Family Trust Funds

Discretionary trusts are subject to the following taxes: 1. Income Tax. A trustee must pay tax on the earnings of the trust. Income within the trust attracts an additional tax rate of 45%. If the income exceeds the standard rate band (£1,000), the earnings within the band are subject to an introductory tax rate of 20%.

Taxability of trusts 18 1210

Family trusts are usually set up as a discretionary trust. Typically, the trustee will have complete discretion as to whether, when, and to whom trust property will be distributed and in what form and amount. In a non-discretionary trust, the trustee(s) must make distributions in accordance with the trust agreement. It is possible for a trust.

.