Cash Management System Types, How It Works & Best Practices

TechnoFunc Cash Management Learning Objectives

Cash Management and Treasury Management products and services are typically considered to be synonymous. They're viewed as "just another commodity" that banks offer. However, wire transfers, sweep accounts, and merchant services are all cash management products that provide business owners with unique opportunities to increase profit, and.

29+ Is Cash Management Service Team Legit to consider ]

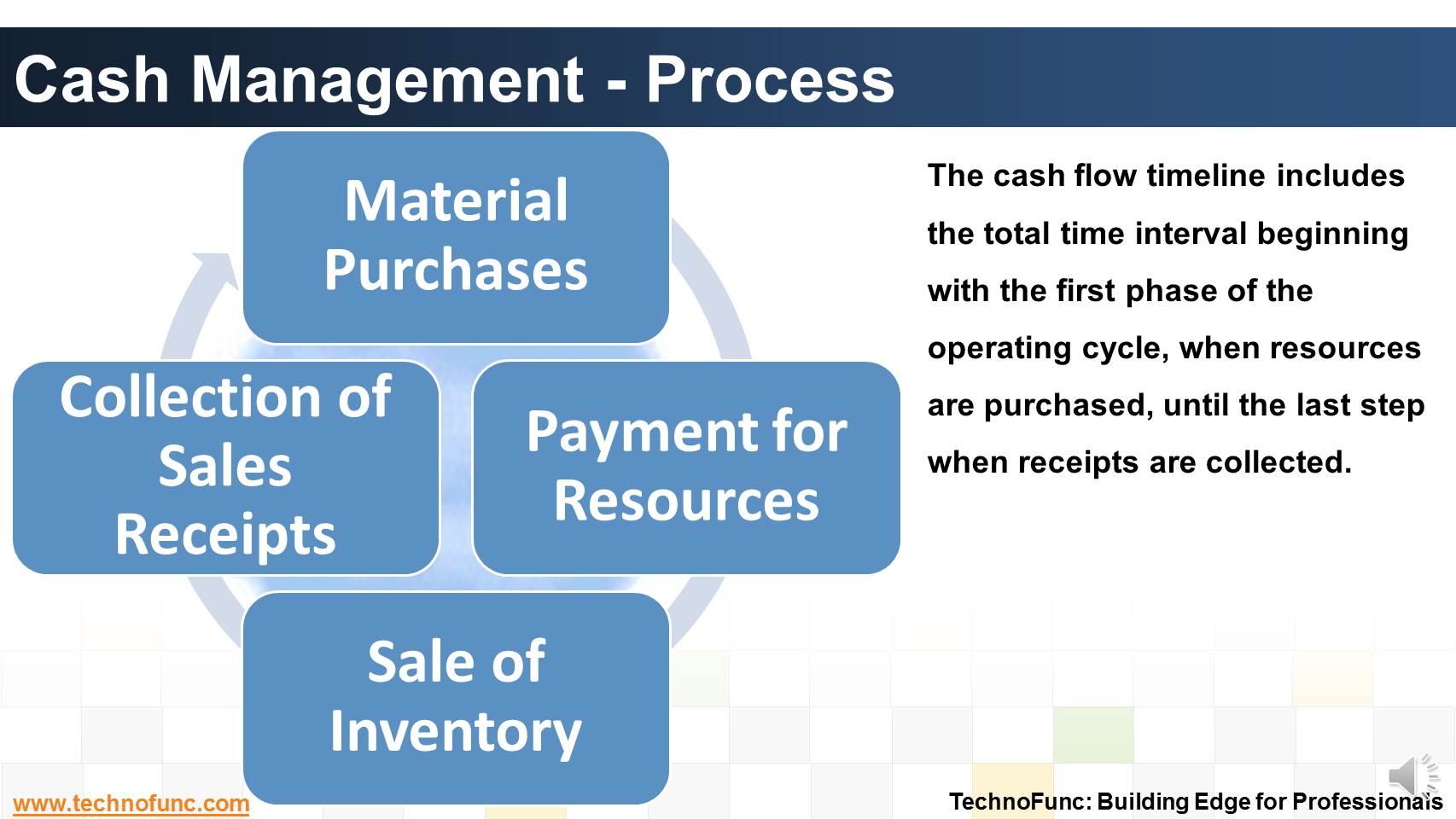

Cash management is the corporate process of collecting and managing cash, as well as using it for (short-term) investing. It is a key component of ensuring a company's financial stability and.

TechnoFunc Cash Management Learning Objectives

Cash Flow Essentials. Get all the essentials. All in one platform. Make payments, get paid faster with digital invoicing and gain valuable insights. Plus peace of mind with ability to protect your business with internal controls. Fees: $49.00/month**. Multiple payment options including: Real-Time Payments (RTP), Domestic ACH payments, Domestic.

TechnoFunc Cash Management Benefits

Cash management accounts (CMAs) offer a combination of services that mimic a checking and a savings account, in a single product, and often with minimal fees, if any. The best CMAs offer you.

What Is Cash Management, And How Can It Benefit My Business?

Cash management, also known as treasury management, is the process that involves collecting and managing cash flows from the operating, investing, and financing activities of a company. In business, it is a key aspect of an organization's financial stability. Cash management is important for both companies and individuals, as it is a key.

Cash Management What You Need to Know CIMA

Cash management is the practice of overseeing and regulating cash flows within a company, crucial for ensuring operational funds and overall financial stability. It is focused on operational efficiency and process improvement, aiming to optimize the flow of money in and out of a company.

Cash management definition and meaning Market Business News

For additional information call 855-955-2760 or visit your local branch for a copy of Business Pricing Information disclosure or visit Your Deposit Account Agreement (YDAA). Want greater control over finances or forecasting cash flow for your business? Our convenient cash services make it possible.

What is Cash Management? YouTube

Improving Cash Management . Even if a company is making a profit by making more revenue than it incurs in expenses, it will have to manage its cash flow correctly to be successful. A company's.

Cash Management System Types, How It Works & Best Practices

CMSINFO businesses include ATM and Retail Cash Management, Banking Automation, ATM-as-a-service, AIoT Remote Monitoring, Software Solutions and Card Issuance, Management & Personalization. CMSINFO is committed to enable financial inclusion by providing access to formal banking services and driving seamless physical payments in India.

Corporate Cash Management Informasi Training Center

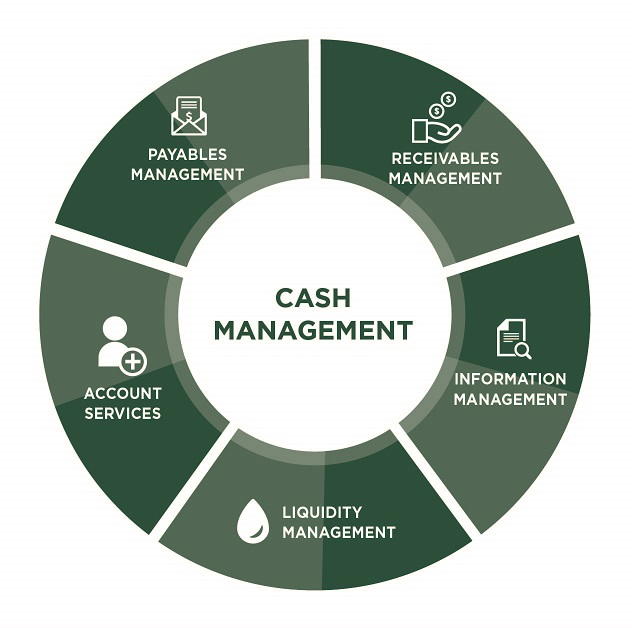

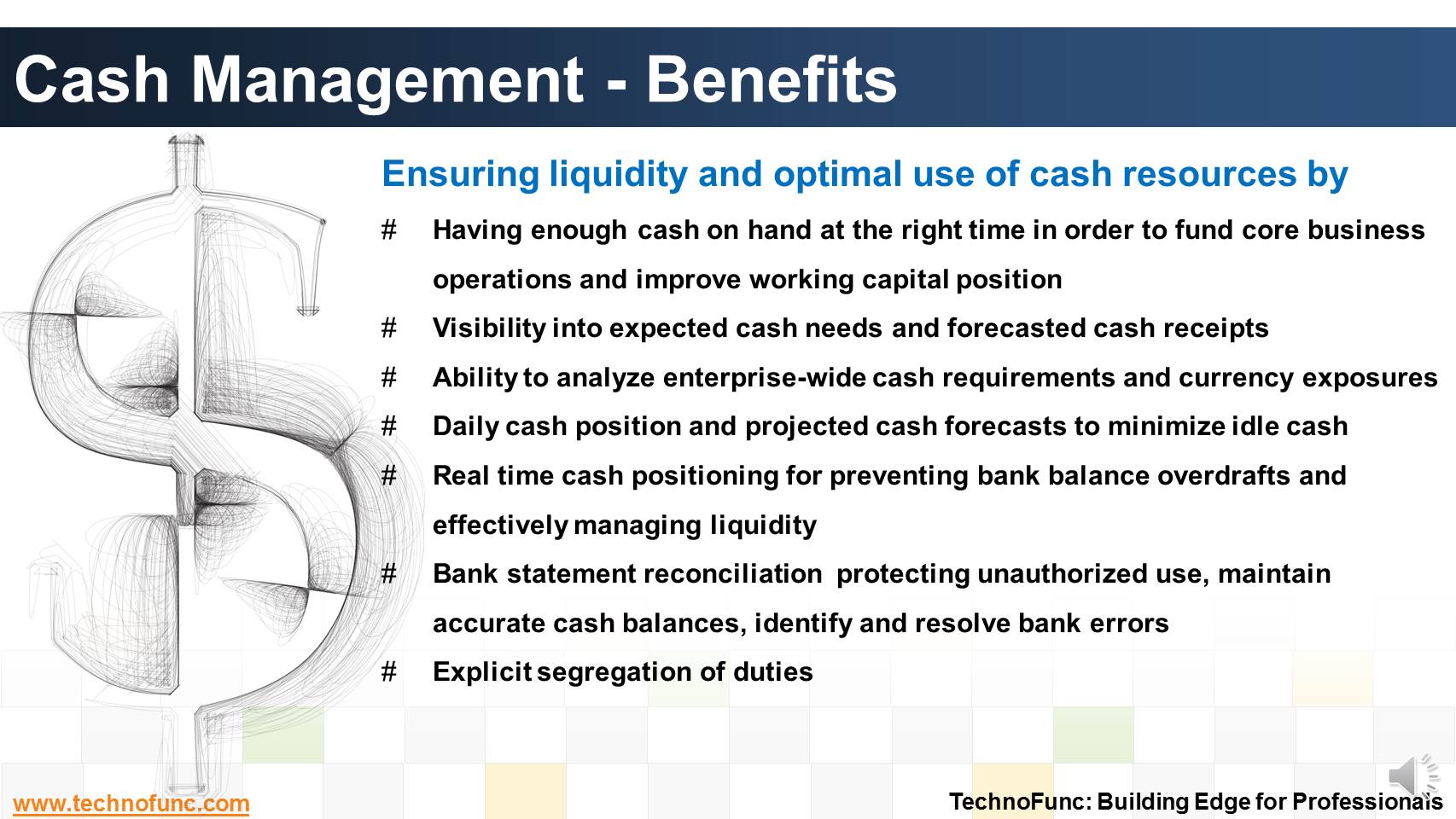

Cash management services play a vital role in the banking industry, providing businesses and organizations with efficient and effective tools to optimize their cash flow and financial operations. In today's fast-paced business environment, managing cash is essential to maintain liquidity, mitigate financial risks, and maximize profitability..

A Complete Guide to Cash Management Strategy Welp Magazine

Cash management is the key component for managing smooth business operations Business Operations Business operations refer to all those activities that the employees undertake within an organizational setup daily to produce goods and services for accomplishing the company's goals like profit generation. read more.

PPT Offerings for Venture Capital / Private Equity PowerPoint Presentation ID4287769

Oracle Fusion Cash Management provides a dashboard for you to easily review and drill down to activity in the application. The following is an overview of the five available infotiles on the dashboard: Cash Balance: Displays the overall cash balance of the company across all its bank accounts.

Why Cash Management and Optimization is a Bank's Greatest Asset Founder's Guide

The Fidelity Cash Management account is a brokerage account designed for investing, spending and cash management. Investing excludes options and margin trading. For a more traditional brokerage account, consider the Fidelity Account. 1. Zero account minimums and zero account fees apply to retail brokerage accounts only.

What is cash management? Safari

A cash management account is a cash account typically offered through nonbank financial institutions, such as: Robo-advisors. Online investment firms. Mobile trading apps. Cash management accounts.

Introduction to Cash Management The Why and How

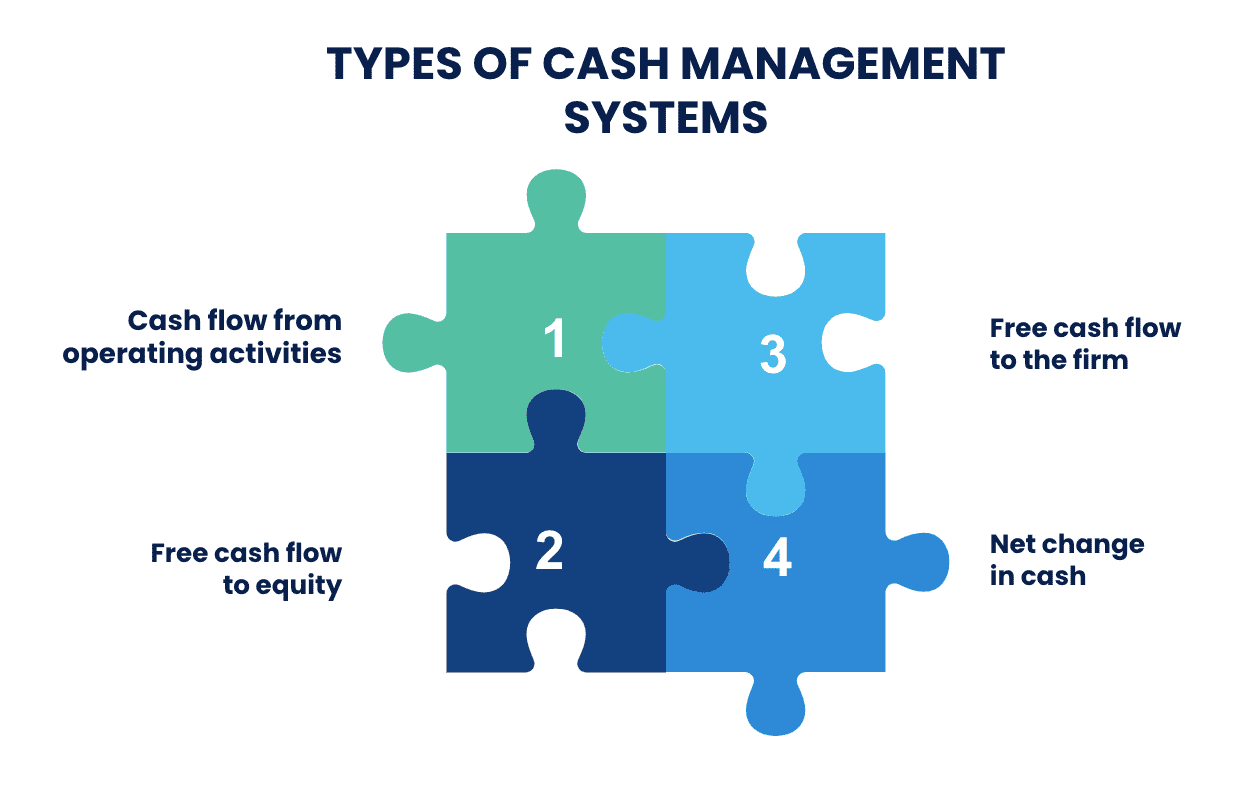

1217. Cash management refers to a broad area of finance involving the collection, handling, and usage of cash. It involves assessing market liquidity, cash flow, and investments. [2] [3] In banking, cash management, or treasury management, is a marketing term for certain services related to cash flow offered primarily to larger business customers.

Internal Cash Management Commercial Cannabis Handbook

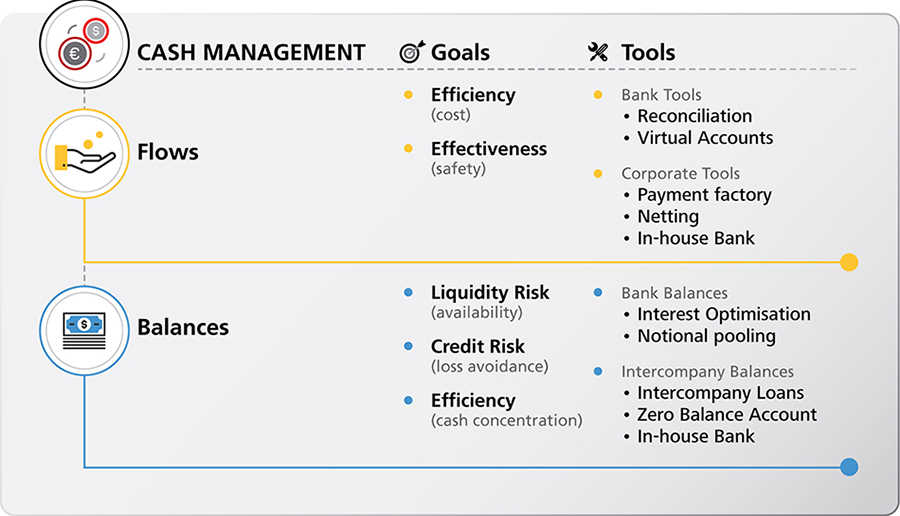

Cash management brings together all of the methods and strategies for managing a company's financial resources. It aims to ensure that the company's structure is cost-effective by monitoring and analysing specific indicators. 👉Cash flow management: the complete guide. Cash management can combine many tasks, including:

.